What Are ETFs?

If you’ve spent any time over the past few years researching investment options you may have heard about ETFs. ETF stands for Exchange Traded Fund. They’ve gained enormous popularity and have become quite trendy.

As with any trend, it’s important to be cautious before jumping in – particularly when your money is potentially at risk. So let’s first look at what an exchange traded fund is. “Exchange Traded” means that it is traded just like a traditional stock. “Fund” means that it is a collection or group of investments, which can include stocks and bonds.

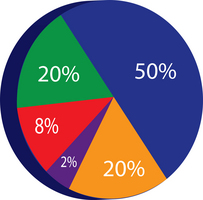

Generally the investments are grouped by industry or theme. For example, you might find an ETF with various pharmaceutical companies. Like other funds, an ETF is then managed by a financial institution. When you buy an ETF you’re buying an investment, managed by someone else, that may have stock in hundreds or thousands of companies.

What are The Advantages and Disadvantages of ETFs?

Not FDIC Insured. This can be too big of a risk for some investors. If you don’t want to risk losing your money then consider a secured investment.

If you’re interested in pursuing ETFs as an investment option, spend some time reviewing the fund’s information. What’s the past performance of the fund? Who manages it and what is their track record? What are the fees, expense ratio and what is the commission rate for your broker? What securities are represented by the fund and what is the performance of those various companies? Finally, how will an ETF help you diversify your portfolio?