How to Avoid the Most Common Investing Mistakes

Regardless of your current income level or the amount you currently have saved or invested, it’s important to go about investing smartly. Past investment successes are no guarantee that you’ll achieve the same level of success in the future, and it’s therefore essential to avoid the mistakes that can put your investment assets at risk.

Many market observers and commentators that avoiding mistakes and unreasonable losses in your investment portfolio is perhaps the most important factor to your long term financial success. Fortunately, many of the common investing mistakes are well-known, so it’s not particularly difficult to avoid them. Here are some tips for doing just that.

- Make Sure You Do Your Research. It’s surprisingly common for investors to downplay or underestimate the risks associated with a potential investment. It’s even more common for individual investors to be ignorant of those risks altogether. Be sure to understand the potential upside and downside of any investment you’re considering by doing your research beforehand.

- Make Sure You Understand What You’re Researching. It’s not enough to just research a potential investment by reviewing past and current performance numbers or other corporate metrics. You need to have the knowledge base to be able to turn that data into an actionable investment decision. If you don’t understand what or how to research an investment, then educate yourself before you commit any of your funds.

- Make Sure You Have an Appropriate Investing Timeframe. In general, you can be more optimistic when it comes to any potential investment when you have a medium to long-term investing timeframe. Choosing volatile investments and only holding them for a short period of time can greatly increase the chances of suffering a loss of capital.

- Make Sure to Choose Investments That are Right For You. There’s no such thing as a “perfect” investment that’s right for everyone — because if there were, most people would probably already be invested in it. The factors that make an investment appropriate for a particular individual include their budget, their investing goals, their investing personality and risk tolerance, and their current investment diversification.

- Make Sure to Make Your Own Decision. There’s nothing wrong with using the financial media, or your friends and family, to help you come up with new investing ideas, or to help you learn about opportunities you weren’t previously familiar with. However, you should always do your own research. Never invest your money simply on the recommendation of market commentator or close friend.

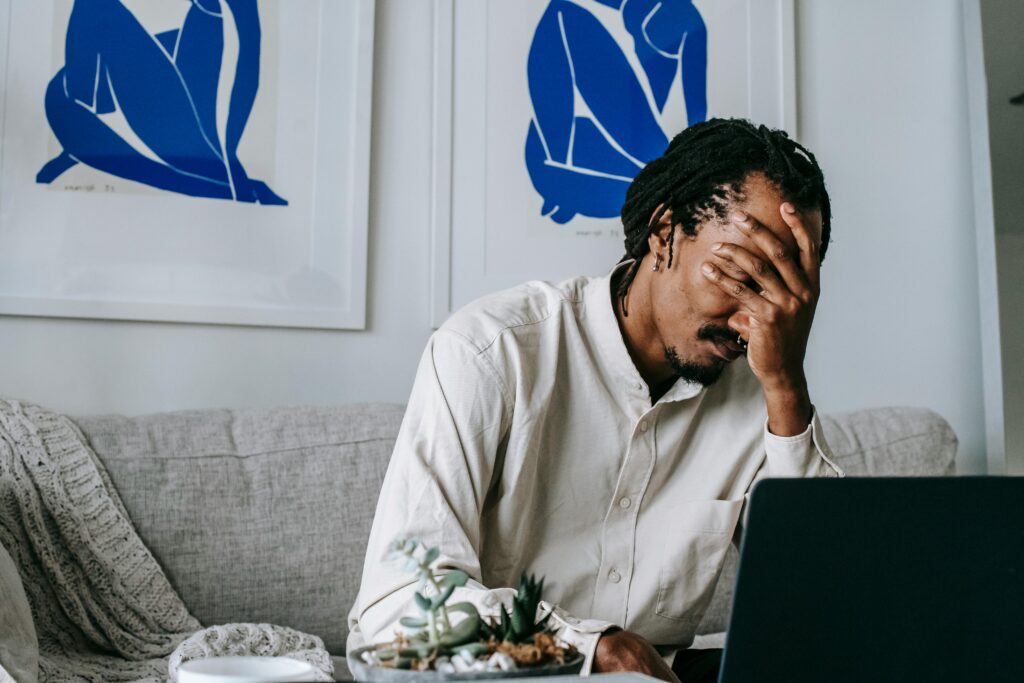

- Getting Emotional With Your Investments. Remember that the purpose of investing is to increase your wealth. Becoming emotionally attached to your investments is a sure-fire way to make bad financial decisions. Only keep an investment that’s fallen in value if you rationally think it will recover, not because you “like” it. And don’t be afraid to think that an investment that’s increased in value is still fairly priced (and that you’d likely add to your investment at that price). If you can’t justify keeping an investment based on research and analysis, then it may be time to move on.

Finally, remember to stay active in your investing. This doesn’t mean checking your stock or mutual fund prices every day, but it does mean periodically revisiting your investment choices and doing the analysis to consider whether they’re still right for you. your results.