Diversify Your Portfolio to Manage Risk

There’s an old adage that says we shouldn’t keep all of our eggs in one basket. This can be interpreted in a number of ways. For investors, it is synonymous with diversifying their portfolios.

Beginning investors often put all of their money into one type of investment. They might purchase stock in a company that is doing well, or a low-risk government bond. These investments are usually quite safe, so the investor is unlikely to lose any money. But they also offer a low rate of return, so investors won’t get rich from them either.

Those who are looking to get rich might put all of their money into a riskier investment that offers a high rate of return. If the investment does well, they stand to gain a decent amount of money. But there’s no guarantee that the investment will perform well. In fact, there’s a pretty good chance that it won’t. And if it doesn’t, the investor could lose everything that he put into it.

Diversification is a happy medium between these two extremes. Instead of putting all of your money into a safe investment that doesn’t earn you much money, or a risky investment that might earn you a lot of money, you spread your money out among investments with varying degrees of risk. By doing this, you can earn stable returns on a portion of your money while gambling a bit with the rest of it.

When you’re investing small amounts of money, diversification might seem counter-productive. And indeed it can be, because commissions will have to be paid on each of your investments if you make them individually. One way to avoid this dilemma is to invest in mutual funds. Mutual funds are investments that put money toward several other investments. The investments are managed by professionals, and their goal is to maximize the returns for mutual fund holders.

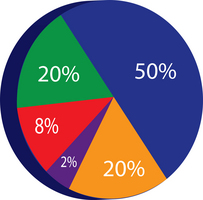

Mutual funds usually divide investments among the following three asset classes:

We’ve all heard stories about investors who lost loads of money on stocks and bonds. But these investors probably didn’t diversify their portfolios. While there is always a certain amount of risk with any investment, if you choose your investments wisely and diversify, you stand a good chance of earning money rather than losing it.