If you’re reading this, it’s a safe bet that you know the importance of investing a portion of your earnings. Everyone should be putting money away for emergencies and retirement. But while most people realize that, relatively few understand how to do so effectively.

If you’re reading this, it’s a safe bet that you know the importance of investing a portion of your earnings. Everyone should be putting money away for emergencies and retirement. But while most people realize that, relatively few understand how to do so effectively.

The truth is you don’t have to be a rocket scientist to make sense out of investing. You just need to be willing to learn. Some aspects of investing are best learned through experience.

Here are five rules of thumb for those who are just getting started.

1. You’re never too young to start saving for retirement. The average life expectancy these days is around twenty years past retirement age. You could live much longer than that. Saving up enough money to sustain yourself for that length of time is no small task. If possible, you should start saving for retirement when you get your first job. And no matter how old you are, if you haven’t started yet, right now is the time to do so.

2. Invest at least 10% of your income (before taxes). If you put it aside out of each paycheck before you pay bills or do any other spending, you’ll never miss it. For those who are not disciplined enough to put that much aside, automation is your friend. Have the money deducted from your pay and put directly into your retirement account, or have it direct deposited into a savings account while the rest goes into checking. And if you can manage to save more than 10%, go for it.

3. Remember the rule of 72. Divide 72 by your investment’s yield percentage, and you’ll get the number of years that it will take you to double your investment. For example, if you’re getting a 6% return, it will take twelve years for your investment to double in value.

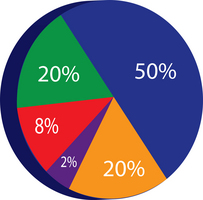

4. Diversification is always important, but the amount of risk you should take varies with age. As a general rule, financial advisers say that you should subtract your age from 100 to see how much of your portfolio should be allocated to stocks. That means that if you’re 30, 70% of your portfolio should consist of stocks and 30% should consist of less risky investments.

5. Don’t forget about transaction costs, inflation and taxes. All of these things take a bite out of the returns on your investments. So when you’re considering a new investment, subtract the inflation rate, transaction charges and any applicable taxes from the return rate. If you end up breaking even or in the red, look for another investment or find a way to cut your costs.

These basic rules should help you get your investments off on the right foot. You can learn the finer points as you go. All investment comes with some amount of risk, but by educating yourself you can lower that risk substantially.

If you’re reading this, it’s a safe bet that you know the importance of investing a portion of your earnings. Everyone should be putting money away for emergencies and retirement. But while most people realize that, relatively few understand how to do so effectively.

If you’re reading this, it’s a safe bet that you know the importance of investing a portion of your earnings. Everyone should be putting money away for emergencies and retirement. But while most people realize that, relatively few understand how to do so effectively.