Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career....

Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career.... Articles Tagged ‘investing advice’

Establish An Investing Discipline When You Are In College

Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career....

Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career....

Tuesday, July 13th, 2010

Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career....

Going to college and establishing what you want to pursue in the future is a great time in your life. The academic and social experiences during the college years are often unlike any others. But even though it seems like the last thing on a student's mind, making the right financial and savings decisions while in college now can impact on their adult life in a very positive way.

The investing discipline I'm describing here (although using traditional bank accounts) is what you need to start doing with stocks, mutual funds and other investments once you begin your working career.... Improve Your Investment Skills

You work hard every day, so you want your money to work for you. Maybe you are accomplishing this with investments. But, everyone can get a little better. If you are looking for ways to increase your portfolio, improving your skills may be in order. Here is some advice on how to improve your investment skills.

Investing is an art that anyone can learn if they want to. Many follow the word of analysts and a financial adviser, but they can only take you so far. They can recommend, but the best fit for you will come from making your...

You work hard every day, so you want your money to work for you. Maybe you are accomplishing this with investments. But, everyone can get a little better. If you are looking for ways to increase your portfolio, improving your skills may be in order. Here is some advice on how to improve your investment skills.

Investing is an art that anyone can learn if they want to. Many follow the word of analysts and a financial adviser, but they can only take you so far. They can recommend, but the best fit for you will come from making your...

Monday, June 14th, 2010

You work hard every day, so you want your money to work for you. Maybe you are accomplishing this with investments. But, everyone can get a little better. If you are looking for ways to increase your portfolio, improving your skills may be in order. Here is some advice on how to improve your investment skills.

Investing is an art that anyone can learn if they want to. Many follow the word of analysts and a financial adviser, but they can only take you so far. They can recommend, but the best fit for you will come from making your...

You work hard every day, so you want your money to work for you. Maybe you are accomplishing this with investments. But, everyone can get a little better. If you are looking for ways to increase your portfolio, improving your skills may be in order. Here is some advice on how to improve your investment skills.

Investing is an art that anyone can learn if they want to. Many follow the word of analysts and a financial adviser, but they can only take you so far. They can recommend, but the best fit for you will come from making your... Minimizing The Risks Of Online Trading

Are you interested in investing in stocks and other commodities? Trading online has become increasingly popular to help increase the size of your portfolio. But, there are risks with day trading. Here is some advice to help minimize the risks of online trading.

The form of online trading most people are interested in is day trading. Day trading can be rewarding if you know what you are doing. You are looking at the market from the standpoint of how stocks, bonds and commodities will change from the opening to the closing of the market on any given day.

Those who want...

Are you interested in investing in stocks and other commodities? Trading online has become increasingly popular to help increase the size of your portfolio. But, there are risks with day trading. Here is some advice to help minimize the risks of online trading.

The form of online trading most people are interested in is day trading. Day trading can be rewarding if you know what you are doing. You are looking at the market from the standpoint of how stocks, bonds and commodities will change from the opening to the closing of the market on any given day.

Those who want...

Monday, May 24th, 2010

Are you interested in investing in stocks and other commodities? Trading online has become increasingly popular to help increase the size of your portfolio. But, there are risks with day trading. Here is some advice to help minimize the risks of online trading.

The form of online trading most people are interested in is day trading. Day trading can be rewarding if you know what you are doing. You are looking at the market from the standpoint of how stocks, bonds and commodities will change from the opening to the closing of the market on any given day.

Those who want...

Are you interested in investing in stocks and other commodities? Trading online has become increasingly popular to help increase the size of your portfolio. But, there are risks with day trading. Here is some advice to help minimize the risks of online trading.

The form of online trading most people are interested in is day trading. Day trading can be rewarding if you know what you are doing. You are looking at the market from the standpoint of how stocks, bonds and commodities will change from the opening to the closing of the market on any given day.

Those who want... How Risky Is Your Investment Portfolio?

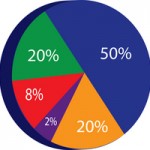

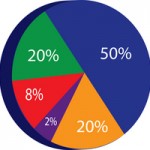

In investment circles you may hear words like “risk” and “diversification.” It relates to how well your investments can do or not do. If you have an investment portfolio or are getting into investing, how you build your portfolio is very important.

Everyone can benefit from investing. It is a proven way to make your money work for you in the long-term. You have earned it; why let it sit and basically gather dust? It could be working just as hard as you did to get it. That is where investing comes in.

A portfolio refers to the investment vehicles that...

In investment circles you may hear words like “risk” and “diversification.” It relates to how well your investments can do or not do. If you have an investment portfolio or are getting into investing, how you build your portfolio is very important.

Everyone can benefit from investing. It is a proven way to make your money work for you in the long-term. You have earned it; why let it sit and basically gather dust? It could be working just as hard as you did to get it. That is where investing comes in.

A portfolio refers to the investment vehicles that...

Friday, April 23rd, 2010

In investment circles you may hear words like “risk” and “diversification.” It relates to how well your investments can do or not do. If you have an investment portfolio or are getting into investing, how you build your portfolio is very important.

Everyone can benefit from investing. It is a proven way to make your money work for you in the long-term. You have earned it; why let it sit and basically gather dust? It could be working just as hard as you did to get it. That is where investing comes in.

A portfolio refers to the investment vehicles that...

In investment circles you may hear words like “risk” and “diversification.” It relates to how well your investments can do or not do. If you have an investment portfolio or are getting into investing, how you build your portfolio is very important.

Everyone can benefit from investing. It is a proven way to make your money work for you in the long-term. You have earned it; why let it sit and basically gather dust? It could be working just as hard as you did to get it. That is where investing comes in.

A portfolio refers to the investment vehicles that... Common Investing Mistakes

No one is planning on working forever. Some sort of investment, whether it is a retirement fund, real estate or other vehicle, needs to be looked at to finance your life after you retire from the world of work. But, be careful. When investing, many novices fall into traps and lose their money. Here is some advice on how to avoid making investment mistakes.

Investing is not the hardest thing in the world, but it does take time and research. Unless you understand what you are investing in, you may want to hold off until you are better informed.

No one is planning on working forever. Some sort of investment, whether it is a retirement fund, real estate or other vehicle, needs to be looked at to finance your life after you retire from the world of work. But, be careful. When investing, many novices fall into traps and lose their money. Here is some advice on how to avoid making investment mistakes.

Investing is not the hardest thing in the world, but it does take time and research. Unless you understand what you are investing in, you may want to hold off until you are better informed.

The first...

Tuesday, March 23rd, 2010

No one is planning on working forever. Some sort of investment, whether it is a retirement fund, real estate or other vehicle, needs to be looked at to finance your life after you retire from the world of work. But, be careful. When investing, many novices fall into traps and lose their money. Here is some advice on how to avoid making investment mistakes.

Investing is not the hardest thing in the world, but it does take time and research. Unless you understand what you are investing in, you may want to hold off until you are better informed.

No one is planning on working forever. Some sort of investment, whether it is a retirement fund, real estate or other vehicle, needs to be looked at to finance your life after you retire from the world of work. But, be careful. When investing, many novices fall into traps and lose their money. Here is some advice on how to avoid making investment mistakes.

Investing is not the hardest thing in the world, but it does take time and research. Unless you understand what you are investing in, you may want to hold off until you are better informed.

Online Investing Pros and Cons

The Internet has made a lot of things much easier than they once were. Instead of loading up and going to the mall, we can shop online. Telecommuting, which was once virtually unheard of, is now pretty common. And while investing in stocks once required a trip to a brokerage, or at least a phone call, it's now possible to do it from the comfort of your own home. Here is some advice on the pros and cons of online investing.

The ability to trade online has attracted many investors who otherwise might not have gotten started. But there is...

The Internet has made a lot of things much easier than they once were. Instead of loading up and going to the mall, we can shop online. Telecommuting, which was once virtually unheard of, is now pretty common. And while investing in stocks once required a trip to a brokerage, or at least a phone call, it's now possible to do it from the comfort of your own home. Here is some advice on the pros and cons of online investing.

The ability to trade online has attracted many investors who otherwise might not have gotten started. But there is...

Monday, March 22nd, 2010

The Internet has made a lot of things much easier than they once were. Instead of loading up and going to the mall, we can shop online. Telecommuting, which was once virtually unheard of, is now pretty common. And while investing in stocks once required a trip to a brokerage, or at least a phone call, it's now possible to do it from the comfort of your own home. Here is some advice on the pros and cons of online investing.

The ability to trade online has attracted many investors who otherwise might not have gotten started. But there is...

The Internet has made a lot of things much easier than they once were. Instead of loading up and going to the mall, we can shop online. Telecommuting, which was once virtually unheard of, is now pretty common. And while investing in stocks once required a trip to a brokerage, or at least a phone call, it's now possible to do it from the comfort of your own home. Here is some advice on the pros and cons of online investing.

The ability to trade online has attracted many investors who otherwise might not have gotten started. But there is... Monitoring Your Investment Portfolio

So you have gotten with a professional investment counselor. They have given you advice on how to go about putting together your investment portfolio to best suit your needs. Now that you have laid out the money, how do you know what your stocks, bonds and other products are doing?

Investing is not a passive, one-time thing. After you go through the process of choosing where and how much to invest, that is only the beginning. Now the process of helping to manage that portfolio begins.

Remember when you were talking to your investment counselor? They probably asked you questions about...

So you have gotten with a professional investment counselor. They have given you advice on how to go about putting together your investment portfolio to best suit your needs. Now that you have laid out the money, how do you know what your stocks, bonds and other products are doing?

Investing is not a passive, one-time thing. After you go through the process of choosing where and how much to invest, that is only the beginning. Now the process of helping to manage that portfolio begins.

Remember when you were talking to your investment counselor? They probably asked you questions about...

Saturday, March 13th, 2010

So you have gotten with a professional investment counselor. They have given you advice on how to go about putting together your investment portfolio to best suit your needs. Now that you have laid out the money, how do you know what your stocks, bonds and other products are doing?

Investing is not a passive, one-time thing. After you go through the process of choosing where and how much to invest, that is only the beginning. Now the process of helping to manage that portfolio begins.

Remember when you were talking to your investment counselor? They probably asked you questions about...

So you have gotten with a professional investment counselor. They have given you advice on how to go about putting together your investment portfolio to best suit your needs. Now that you have laid out the money, how do you know what your stocks, bonds and other products are doing?

Investing is not a passive, one-time thing. After you go through the process of choosing where and how much to invest, that is only the beginning. Now the process of helping to manage that portfolio begins.

Remember when you were talking to your investment counselor? They probably asked you questions about... What are TIPS?

You've probably heard about Treasury Inflation-Protected Securities (TIPS). They are treasury bonds that adjust their interest and principal payments with inflation. TIPS will likely become much more popular with the perceived inflation risk that may loom in the future.

Like other Treasury securities, TIPS pay interest every six months and repay the total principal amount when they mature. The difference is that TIPS' principal value increases automatically based on the inflation rate as measured by the Consumer Price Index (CPI). So therefore when the CPI rises, the principal value of the TIPS also increases. Interest payments also rise because the...

You've probably heard about Treasury Inflation-Protected Securities (TIPS). They are treasury bonds that adjust their interest and principal payments with inflation. TIPS will likely become much more popular with the perceived inflation risk that may loom in the future.

Like other Treasury securities, TIPS pay interest every six months and repay the total principal amount when they mature. The difference is that TIPS' principal value increases automatically based on the inflation rate as measured by the Consumer Price Index (CPI). So therefore when the CPI rises, the principal value of the TIPS also increases. Interest payments also rise because the...

Wednesday, March 10th, 2010

You've probably heard about Treasury Inflation-Protected Securities (TIPS). They are treasury bonds that adjust their interest and principal payments with inflation. TIPS will likely become much more popular with the perceived inflation risk that may loom in the future.

Like other Treasury securities, TIPS pay interest every six months and repay the total principal amount when they mature. The difference is that TIPS' principal value increases automatically based on the inflation rate as measured by the Consumer Price Index (CPI). So therefore when the CPI rises, the principal value of the TIPS also increases. Interest payments also rise because the...

You've probably heard about Treasury Inflation-Protected Securities (TIPS). They are treasury bonds that adjust their interest and principal payments with inflation. TIPS will likely become much more popular with the perceived inflation risk that may loom in the future.

Like other Treasury securities, TIPS pay interest every six months and repay the total principal amount when they mature. The difference is that TIPS' principal value increases automatically based on the inflation rate as measured by the Consumer Price Index (CPI). So therefore when the CPI rises, the principal value of the TIPS also increases. Interest payments also rise because the... Market Capitalization

In the investment world of stocks, bonds, bulls and bears, there are many terms that you may have heard about but are not familiar with. One of those terms is market capitalization.

Companies are classified in many ways. These classifications are used to help determine how much a company is worth. Market capitalization (or market cap for short) is one way of doing that. It is a measure of value that takes into account the total number of outstanding shares that a company has, multiplied by the current price of the stock.

Most people would normally think that a large...

In the investment world of stocks, bonds, bulls and bears, there are many terms that you may have heard about but are not familiar with. One of those terms is market capitalization.

Companies are classified in many ways. These classifications are used to help determine how much a company is worth. Market capitalization (or market cap for short) is one way of doing that. It is a measure of value that takes into account the total number of outstanding shares that a company has, multiplied by the current price of the stock.

Most people would normally think that a large...

Monday, February 22nd, 2010

In the investment world of stocks, bonds, bulls and bears, there are many terms that you may have heard about but are not familiar with. One of those terms is market capitalization.

Companies are classified in many ways. These classifications are used to help determine how much a company is worth. Market capitalization (or market cap for short) is one way of doing that. It is a measure of value that takes into account the total number of outstanding shares that a company has, multiplied by the current price of the stock.

Most people would normally think that a large...

In the investment world of stocks, bonds, bulls and bears, there are many terms that you may have heard about but are not familiar with. One of those terms is market capitalization.

Companies are classified in many ways. These classifications are used to help determine how much a company is worth. Market capitalization (or market cap for short) is one way of doing that. It is a measure of value that takes into account the total number of outstanding shares that a company has, multiplied by the current price of the stock.

Most people would normally think that a large... Diversify Your Portfolio to Manage Risk

There's an old adage that says we shouldn't keep all of our eggs in one basket. This can be interpreted in a number of ways. For investors, it is synonymous with diversifying their portfolios.

Beginning investors often put all of their money into one type of investment. They might purchase stock in a company that is doing well, or a low-risk government bond. These investments are usually quite safe, so the investor is unlikely to lose any money. But they also offer a low rate of return, so investors won't get rich from them either.

Those who are looking to get rich...

There's an old adage that says we shouldn't keep all of our eggs in one basket. This can be interpreted in a number of ways. For investors, it is synonymous with diversifying their portfolios.

Beginning investors often put all of their money into one type of investment. They might purchase stock in a company that is doing well, or a low-risk government bond. These investments are usually quite safe, so the investor is unlikely to lose any money. But they also offer a low rate of return, so investors won't get rich from them either.

Those who are looking to get rich...

Thursday, December 31st, 2009

There's an old adage that says we shouldn't keep all of our eggs in one basket. This can be interpreted in a number of ways. For investors, it is synonymous with diversifying their portfolios.

Beginning investors often put all of their money into one type of investment. They might purchase stock in a company that is doing well, or a low-risk government bond. These investments are usually quite safe, so the investor is unlikely to lose any money. But they also offer a low rate of return, so investors won't get rich from them either.

Those who are looking to get rich...

There's an old adage that says we shouldn't keep all of our eggs in one basket. This can be interpreted in a number of ways. For investors, it is synonymous with diversifying their portfolios.

Beginning investors often put all of their money into one type of investment. They might purchase stock in a company that is doing well, or a low-risk government bond. These investments are usually quite safe, so the investor is unlikely to lose any money. But they also offer a low rate of return, so investors won't get rich from them either.

Those who are looking to get rich...